HomeOwnership Center

Empowering Delaware families to achieve the dream of homeownershipBoard

Staff

Supporters

Latest News

Creating pathways to homeownership, financial security, and generational wealth

The HomeOwnership Center (HOC) at ICHDE is a vital resource for empowering individuals and families to achieve homeownership and financial stability. Offering a range of services—including housing counseling, foreclosure prevention, financial literacy education, budgeting support, credit repair, and first-time homebuyer workshops—the HOC has been a trusted partner to over 17,000 clients since its founding in 2006 as Delaware’s first NeighborWorks America HomeOwnership Center.

Our HOC team is extremely well-qualified, with each housing counselor bringing decades of experience serving Delaware residents. Our HUD-Certified counselors are certified by NeighborWorks®America in Homebuyer Education, Mortgage Lending, Loan Portfolio Management, Homeownership Counseling, Foreclosure Prevention Counseling. All HOC programming is available in both English and Spanish. For of our seven HOC staff are bilingual in English and Spanish.

Designed to support low- to moderate-income households, HOC programming emphasizes education, preparation, and practical solutions. Our services help clients navigate complex challenges such as predatory lending, loan defaults, language and cultural barriers, and the lack of accessible financial education.

Interested in taking advantage of our HomeOwnership Center services? See our application forms here.

Take our eHome America training

Start now at this link

Stand By Me

With a personal coach on your side, you can build your credit score, reduce your debt, and achieve the dream of homeownership.

Through one-on-one support from a personal financial coach, Stand by Me HOME will see if you meet the criteria needed to qualify for a mortgage and connect you with consumer-friendly mortgage programs that include competitive mortgage rates and flexible lending criteria.

Call 1-800-560-3372 or sign up online to get started.

Este servicio está disponible en español.

Foreclosure Prevention

If you are in danger of losing your home to foreclosure, our counselors will work with you to do everything possible to help you save your home. During your intake interview, the counselor will discuss loss mitigation options such as loan modification, mediation, and budget counseling to consolidate debt.

If you have a Sheriff’s Sale Date, please contact us immediately.

If you would like to meet with one of our counselors to discuss your mortgage, schedule an appointment with our Intake Coordinator at (302) 652-3991 ext. 100.

Asistencia disponible en español.

Financial Literacy Workshops

Our Financial Literacy Workshops provide the tools to make good financial choices, plans, and set goals. With this knowledge, our graduates can begin a stronger financial future that includes asset building.

Participants learn how to:

- Use checking and savings accounts to better manage their money

- Change your financial behavior(s) to improve your credit score

- Track expenses and identify areas for improved money management

- Develop and maintain a budget

- Become mortgage ready

Curso disponible en español.

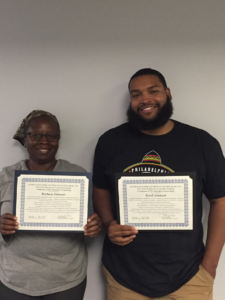

First-Time Homebuyer Workshops

Are you ready to purchase a home, but don’t know where to begin?

Attend our First-Time Homebuyer Workshop and learn what you need to know to get started. Upon completion, you’ll earn a certificate that can help you qualify for a down payment and settlement assistance.

Topics covered include:

- Mortgage Finance Options

- Budgeting and planning

- Working effectively with Realtors

- Shopping for a home

- Purchase & Sales Agreements

- Importance of a Home Inspection

- Insurance and Safety

- The Role of the Housing Counselor

Curso disponible en español.

E-Home America

Online Homebuyer’s Course

Clients may elect to take an online Home Buyer Education workshop via eHome America for a fee of $150 for an individual course. Group courses are also available.

Once the course is successfully completed, appointments can be scheduled with a Housing Counselor to receive certification.

Note: To receive a Certificate of Completion you need:

An agreement of sale to purchase a home;

To complete a counseling appointment with a housing counselor (face-to-face* or via phone).

New Castle County Down Payment and Settlement Assistance program requires a face-to-face appointment.

Zoom Orientation Workshops

Free monthly orientations on Zoom to answer any of your questions about the home-buying process.

Call (302) 652 – 3991, Ext. 100 to register.

Curso disponible en español.

Interested in taking advantage of our HomeOwnership Center services? See our application forms here.